Frequently Asked Questions - Brink's Money

Frequently Asked Questions

Our goal is to use straightforward language to describe what we do because we know that financial terms can sometimes be confusing. We hope you find these frequently asked questions useful. Of course, if you still have any questions, please contact us.

Brink's Money

The Brink's Money Prepaid Mastercard has been designed to take advantage of the features and services available to Netspend cardholders, including access to Netspend Reload Network locations. You get the benefit of a unique new product in addition to the experience, features and services of a company that has been around for two decades.

Getting a Brink's Money Prepaid Mastercard

Q: How do I get a Brink's Money Prepaid Mastercard?

A: Fill out a simple online order form, and we will ship you a personalized Card. You will receive your Card in the mail in approximately 7-10 business days. There is no credit check and there is no fee to order the Card. Residents of the State of Vermont are ineligible to open a Card Account. To use the Card, you will need to activate the Card, verify your identity* and register the Card.

Q: How long does it take to receive my Brink's Money Prepaid Mastercard in the mail?

A: You should receive your Card in approximately 7-10 business days after you place your order. If you do not receive your Card within 10 business days, call Customer Service at 1 (877) 849-3249.

Q: What do I do when I receive my Brink's Money Prepaid Mastercard in the mail?

A: When your Card arrives, read the enclosed materials including the Cardholder Agreement then activate your Brink's Money Prepaid Mastercard. It's simple to activate it online or over the phone. Follow the printed instructions that arrive with your Card. You will be required to provide your name, address, date of birth and your government ID number. The bank that issues the Card must collect this information in accordance with The USA PATRIOT Act, a Federal law that requires all financial institutions to obtain, verify and record information that identifies each person associated with an account*.

Q: How much does it cost to order a Brink's Money Prepaid Mastercard?

A: There is no cost to order and activate a Brink's Money Prepaid Mastercard . Once you activate the Card and verify your identity*, you may be able to choose from our selection of fee plans. To view the fee plans and other costs associated with using the Card ordered through this website, see our fee schedule.

Adding Money to a Brink's Money Prepaid Mastercard

Q: How do I add money to my Brink's Money Prepaid Card Account?

A: Choose from the following ways to add money to your Brink's Money Prepaid Mastercard:

Direct Deposit:

Direct Deposit is one of the most convenient ways to add your paycheck or government payments check to your Brink's Money Prepaid Mastercard. Learn more. If you already have a Brink's Money Prepaid Card Account click here to get the Bank Routing Number (sometimes referred to as the 'ABA Routing Number') and your Account Number. These numbers are necessary to set up Direct Deposit.Reload Network Locations:

There are more than 130,000 convenient locations in the U.S. where you can load money to your Brink's Money Prepaid Card Account using the Netspend Reload Network. Our Reload Center locator helps you find the lowest-cost locations nearest to you. Fee may be assessed by reload location and may vary from location to location.Bank Transfers:

Add money from virtually any U.S.-issued bank account. If you have a checking or savings account or a bank debit card, use it to add money to your Brink's Money Prepaid Card Account. Log in to learn more. (Fees may apply.)PayPal Transfers:

Transfer money from your PayPal account to your Brink's Money Prepaid Card Account at no cost. Your money is generally available in 2-3 business days. Log in to learn more. (Terms and restrictions apply.)Transfer money between Brink's Money Prepaid Mastercard Card Accounts and other Netspend Card Accounts:

It's simple to transfer money from one Brink's Card Account to another. And because your Card is part of the Netspend family, you can also transfer money to any other Netspend Card Account at no cost via your Online Account Center. Log in to learn more.Tax Refunds:

You can have the IRS electronically deposit your refund directly to your Card Account.Mobile Check Load**:

You can load checks to your Card Account at your convenience. Load the money to your Card Account anywhere — without the hassle of waiting in line. And, it's as simple as taking a few pictures. Download the Brink's Money Prepaid Mobile App.***

Q: How do I enroll in Direct Deposit?

A: Enrolling in Direct Deposit takes just a few steps:

Paychecks:

All or part of your paycheck can be directly deposited to your Brink's Money Prepaid Card Account. You will need to provide your employer the bank routing number (sometimes referred to as the 'ABA Routing Number') and your account number. Log in to get the bank routing number and your account number.Tax Refunds:

Get Federal and State tax refunds faster* than you would by mail. Just have them electronically deposited directly into your Brink's Money Prepaid Card Account. Log in to get the bank routing number and your account number.

*Faster access claim is based on comparison of a disbursement via direct deposit vs. disbursement via a mailed paper check. For up-to-date information from the IRS, visit www.irs.gov/refunds.

Q: How do I find the routing number and my account number to enroll in Direct Deposit?

A: You can find the routing number and your account number in a number of ways.

- Log in to your Online Account Center. From the main menu, select "Add/Manage Money" and then "Direct Deposit." The information required to sign up for Direct Deposit will appear in the grey box on the right side of the screen or click here.

- If you enrolled in Anytime Alerts™, text DIRECT to 22622. Customer Service will text you the routing number and account number. Data and text message fees may apply. Check with your mobile provider.

- Call 1 (877) 849-3249 and select the "Other Services" option to get your Direct Deposit information.

If you don't have a Brink's Money Prepaid Mastercard and would like to sign up for direct deposit, your first step is to order a Brink's Money Prepaid Mastercard. When you receive the Card in the mail, it comes with Direct Deposit enrollment instructions, including how to get the routing and account numbers.

Q: Which government payments can I have directly deposited into my Brink's Money Prepaid Card Account?

A: They are:

Social Security payments

Pension and other regular payments

Supplemental Security Income (SSI)

Social Security Disability Act (SSDI)

Veterans Administration Compensation and Pension

Railroad Retirement Benefits (RRB)

Defense Finance and Accounting Service Payments (DFAS)

State unemployment benefits (varies by state)

Government payments must be deposited in full.

Q: When will my Direct Deposit funds be available?

A: The Brink's Money Prepaid Mastercard gives you access to your money as soon as the funds are electronically deposited to your Card Account - that can be up to 2 days faster than you'd expect. Your Card Account must be active and in good standing in order for electronic direct deposits to be credited.

Processing of a direct deposit requires that the name associated with the direct deposit (the payee) be the same as the name associated with the Card Account. Card load limits apply. Faster access to funds is based on comparison of traditional banking policies versus electronic direct deposit. Direct deposit and earlier availability of funds are subject to payor's support of this feature and timing of payor's funding. Check with your payor to find out when the direct deposit of funds will start.

Q: How can I find the lowest-cost reload location nearest to me?

A: Some locations may not charge a fee, but others may. Load fees vary from zero to $3.95. Find the lowest-cost Netspend Reload Network location nearest to you.

Using your Brink's Money Prepaid Mastercard

Q: How do I check my Card Account balance?

A: Ways to check your balance for no charge:

Log in to your Online Account Center, where you can see your balance, your deposits and transaction history.

If you enrolled in Anytime Alerts™ to receive a text message including your Brink's Money Prepaid Card Account balance, after every transaction. After you've signed up for Anytime Alerts, text the letters "BAL" to 22622 anytime, and your Card Account balance will be sent to your mobile phone. (Data and text message fees may apply. Check with your mobile provider.)

Call our toll-free number 1 (877) 849-3249.

Ways to check your balance for a $0.50 fee:

Visit a participating ATM located in the U.S.

Q: What can I buy with my Brink's Money Prepaid Mastercard?

A: With a Brink's Money Prepaid Mastercard, you can make purchases at stores, over the phone and online. Use the Card anywhere Debit Mastercard is accepted.

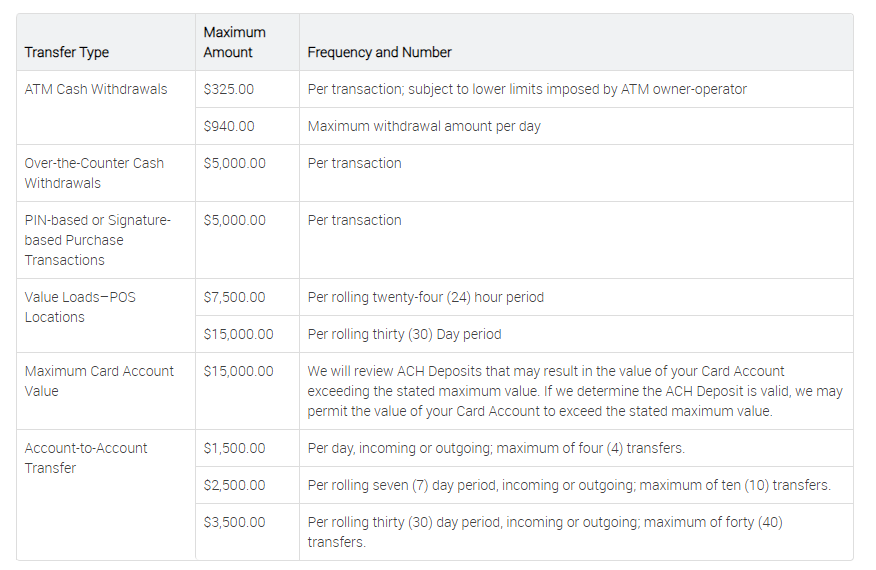

Q: What are the limits that apply to my Card Account?

A: There are limits affecting how much money can be loaded, withdrawn and spent by each Cardholder.

The maximum amount you can spend or withdraw at a time varies by type of transaction. Use this chart to determine the limits. For security reasons, we may further limit the amount or number of transactions described below.

We determine the maximum cumulative amount of your value loads and your Card Account by aggregating activity and value of all Card Accounts you have that are managed by Netspend (issued by any bank), whether you are a Primary Cardholder or Secondary Cardholder

Q: Can I use my Card at ATMs?

A: You can use your Card to withdraw cash at virtually any ATM that displays the Mastercard Acceptance Mark. You will be charged a fee of $2.50 for this convenience (applies to domestic ATM withdrawals; see the Cardholder Agreement for details). The owner of the ATM may also charge a fee.

Q: Can I avoid paying ATM fees?

A: Yes you can! When making purchases at many retailers, such as grocery stores, select "DEBIT" and enter your PIN to get cash back.

Q: What do I do if my Card is lost or stolen?

A: Immediately call Customer Service at our toll-free number, 1 (877) 849-3249. Or, log in to your Online Account Center to report your Brink's Money Prepaid Mastercard as lost or stolen. From the main menu, select "My Account," "My Prepaid Cards" and then "Report Card Lost/Stolen". You will also be able to order a new Card.

Q: How do I transfer money to my Savings Account?

A: Log in to your Online Account Center to transfer money between your Brink's Money Prepaid Card Account and your Savings Account.

Q: How do I dispute a charge from a merchant?

A: Ways to dispute:

Call Customer Service at our toll-free number 1 (877) 849-3249 or file a dispute online.

Log in to your Online Account Center.

From the main menu, select "Help" and then "File a Dispute" to start the dispute process.

You will need your PIN to access this online service.

Q: How do I close my Brink's Money Prepaid Card Account?

A: You can close your Card Account by calling Customer Service 1 (877) 849-3249 or logging in to the Online Account Center to request your unused Card Account balance be sent to you via check (mailed within 20 business days to the address we have on file). There is a fee for sending you a check (see the Cardholder Agreement for more information). We may not issue a refund check for any unused balance amount less than $1.00.

Security Information

What do I do if I think I am a victim of fraud?

Call us immediately, if you think you or your Brink's Money Prepaid Card Account may have been subject to fraudulent activity.

By Phone:

Toll-free: 1 (877) 849-3249

Monday through Friday: 8AM-10PM (Central Standard Time - CST)

Saturday & Sunday: 8AM-8PM (Central Standard Time - CST)

Closed on federal holidays.

By Email:

Email us your information using your secure inbox. Login to the Online Account Center to use this service. We will respond to your request within 48 hours.

By Mail:

Brink's Money Prepaid Mastercard

c/o Netspend Corporation

PO Box 2136

Austin, TX 78768-2136

What do I do if I receive a suspicious email asking for my personal or account information?

If you think you've received a fraudulent e-mail related to your Brink's Money Prepaid Mastercard, please forward it to brinksprepaid@netspend.com and we will investigate it for you. You'll receive an automated response to let you know we received your e-mail.

Are links on www.BrinksPrepaidMastercard.com safe?

We are not responsible for the information provided by, or the security of sites linked to or from our website. In most cases, links to non-Brink's Money Prepaid Mastercard websites are provided solely as pointers to information on topics that may be useful to the users of the Brink's Money Prepaid Mastercard website. Third party websites may have different privacy policies and/or security standards governing their sites.

How can I protect myself from fraud?

Fraud Protection begins with knowing your personal and Card Account information is safe. Control your Information.

Don't share your Card Account number or Personal Identification Number (PIN) with anyone. Don't write your PIN anywhere on your card, on any of the other materials that came with your card, or on print-outs of your card activity summaries. Always guard your Card Account number and PIN!

If you use Brink's Money Prepaid Mastercard Online Banking, don't share your username and password with anyone. Try to avoid writing it down and storing it somewhere where it can be easily lost. For more protection, change your password every 90 days and never use the same password for all of your online accounts.

Check your Brink's Money Prepaid Mastercard Online Account Center page on a regular basis, even if you are not using your Card on a regular basis.

What do I do if I see something unusual on my Card Account?

If you think something unusual is going on with your Brink's Money Prepaid Card Account or if you receive a communication (email/phone call/text) that doesn't seem right, call the Customer Service number on the back of your Brink's Money Prepaid Mastercard at 1 (877) 849-3249.

What can I do to protect my personal and Card Account information from Phishing and Social Media Scams?

You can access additional information on how to protect yourself and your personal information by visiting www.brinksprepaidmastercard.com .

Use the following link for more information about Phishing and how to protect yourself from these scams: What is Phishing?

I didn't order a card but I received a Brink's Money Prepaid Mastercard in the mail. How did you acquire my contact information for the offer mailing?

We rely on affiliate marketing services as a source for reaching potential new customers. Because we feel strongly about customer privacy, we only contract with marketing affiliates that have collected the information from consumers that indicate they are 18 years of age or older, and have received permission to share it with us. We do not intentionally offer the Brink's Money Prepaid Mastercard to people under the age of 18. For more information about how we collect and use personal information, please see our Online Privacy Policy available at www.netspend.com/privacy.

The Brink's Money Prepaid Mastercard is not a credit card and no credit report has been or will be obtained in connection with this prepaid card offer. The card is not active, nor does it have any monetary value. In order to use the card it must first be activated. As part of card activation we verify the identity of the person to ensure that the person activating the offer is at least 18 years old. If the recipient's identity cannot be verified or they are under the age of 18, the activation attempt is rejected.

If you would like to take advantage of all the features and benefits of the card, you'll need to activate it, verify your identity* and add funds to the card. You can activate it by calling 1-877-788-9067 or going to ActivateBrinks.com. If you do not want this card, you can simply shred or dispose of it securely.

How do I remove my name off of future offer mailing offers?

To opt out of future mail offers, call 877-849-3249, e-mail brinksprepaid@netspend.com, or write to: NS Consumer Opt-Out, P.O. Box 2136, Austin, TX 78768. Please allow 30 days for processing of your request.

* IMPORTANT INFORMATION FOR OPENING A CARD ACCOUNT: To help the federal government fight the funding of terrorism and money laundering activities, the USA PATRIOT Act requires us to obtain, verify, and record information that identifies each person who opens a Card Account. WHAT THIS MEANS FOR YOU: When you open a Card Account, we will ask for your name, address, date of birth, and your government ID number. We may also ask to see your driver's license or other identifying information. Card activation and identity verification required before you can use the Card Account. If your identity is partially verified, full use of the Card Account will be restricted, but you may be able to use the Card for in-store purchase transactions. Restrictions include: no ATM withdrawals, international transactions, account-to-account transfers and additional loads. Use of Card Account also subject to fraud prevention restrictions at any time, with or without notice. Residents of Vermont are ineligible to open a Card Account.

** Mobile Check Load is a service provided by First Century Bank, N.A. and Ingo Money, Inc., subject to the First Century Bank and Ingo Money Terms and Conditions, and Privacy Policy. Approval review usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money's sole discretion. Fees apply for approved Money in Minutes transactions funded to your card. Unapproved checks will not be funded to your card. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for message and data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card. See your Cardholder Agreement for details.

*** No charge for this service, but your wireless carrier may charge for messages or data.

The Brink's Money Prepaid Mastercard is issued by Republic Bank & Trust Company, Member FDIC, pursuant to a license by Mastercard International Incorporated. Netspend is a registered agent of Republic Bank & Trust Company. Certain products and services may be licensed under U.S. Patent Nos. 6,000,608 and 6,189,787. Use of the Card Account is subject to activation, ID verification, and funds availability. Transaction fees, terms, and conditions apply to the use and reloading of the Card Account. See the Cardholder Agreement for details.

Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Card may be used everywhere Debit Mastercard is accepted.

© 2022 Netspend Corporation. All rights reserved worldwide. Netspend is the federally registered U.S. service mark of Netspend Corporation. All other trademarks and service marks belong to their owners.

More from our insights library:

Money Tips from Women to Women

When it comes to being independent and having the tools to succeed, our rights as women have come a long way in the past 100 years. Regardless of this progress, the financial playing field between men and women still isn’t balanced. That's why taking the reins of your financial future is an important power move to ensure you are looking out for yourself. As a result, we have outlined a few money tips:

The Factors That Actually Matter When Revising Your Credit

A credit score is used by lenders to determine what the risk of loaning money to an applicant is. Knowing what factors truly matter towards generating your credit score is helpful if you are interested in qualifying for the best interest rate or maximizing your score’s potential. Read on for the five most important factors affecting your credit score.

Benefits of Virtual Cards for Business Owners

As an add-on card to your existing account, virtual cards can be great for contactless pay either as a one-time deal or recurring usage. With more businesses becoming digital and online purchases being more popular than ever, virtual cards offer an array of benefits for business owners. Read on to learn more about the benefits of virtual cards for business owners.